How Spray Foam Insulation Can Affect a Mortgage

Imagine you're looking to buy a house, and you find the perfect one. It's got everything you want, including spray foam insulation. You might not think much of it at first, but did you know that this insulation can actually impact your mortgage? Let's dive into how.

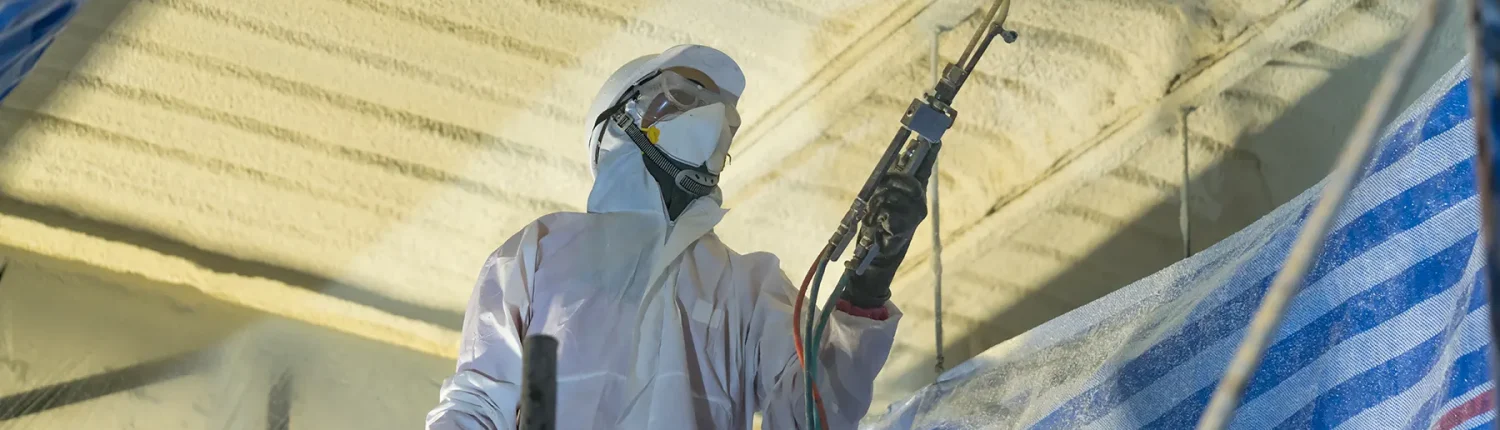

What is Spray Foam Insulation?

Spray foam insulation, a contemporary insulating method, is praised for its effectiveness in maintaining a comfortable temperature in homes throughout the year. Available in open-cell and closed-cell varieties, each offers unique advantages. However, its impact on a mortgage should be considered, especially if the installation is poor.

Potential Negative Impact of Spray Foam Insulation on Mortgages

While insulation can significantly enhance a property's value, poorly installed spray foam insulation can have the opposite effect. Substandard installation might lead to complications, making a home less appealing to buyers and appraisers, potentially reducing its market value. This can be a critical concern for those seeking mortgage approval.

Spray Foam Insulation and Mortgage Approval Challenges

Lenders assess both the condition and value of a property when considering a mortgage. While high-quality spray foam insulation can be advantageous, boosting a property's value and energy efficiency, the presence of poorly installed insulation can be detrimental. It can lead to mortgage refusals, making professional removal essential.

Polarblast's Professional Removal Services

In instances where spray foam insulation needs to be removed due to poor installation, Polarblast offers professional spray foam removal services. Their expertise ensures that any problematic insulation is efficiently and safely extracted, mitigating any negative impact on mortgage approval and property value.

Energy Efficiency and Mortgage Rates

It's worth noting that homes with higher energy efficiency can often secure more favourable mortgage rates. Properly installed insulation, including spray foam, plays a significant role in this efficiency, suggesting that well-installed insulation could reduce mortgage payments over time.

Long-Term Financial Considerations

Though initially more costly than traditional insulation, spray foam insulation's long-term savings are notable. It effectively reduces energy bills, which could lead to substantial financial savings over time.

Health and Safety Considerations

The health implications are equally important. Certain types of spray foam insulation have been associated with health hazards, emphasising the need for safety compliance in your prospective home’s insulation.

Insurance Factors

Insurance companies often consider the type of insulation when setting premiums. Quality insulation, like spray foam, can sometimes result in reduced insurance costs, offering another financial advantage.

Environmental Considerations

In today's environmentally aware society, a home's ecological impact is significant. Spray foam insulation is generally viewed as environmentally friendly, making it not only beneficial for the planet but also potentially attractive to some lenders and insurance firms.

Installation Process and Its Impact on Mortgages

The installation of spray foam insulation is intricate, and its execution can influence a property’s eligibility for a mortgage. Ensuring that it is installed by qualified professionals is crucial.

Case Study: The Real-World Effect of Spray Foam Insulation

Consider a homeowner whose property value rose after installing spray foam insulation, leading to an easier mortgage refinancing process. Such examples demonstrate the practical influence of insulation on mortgages.

Insights from Industry Experts

Professionals in the field often underscore the financial advantages of spray foam insulation in relation to mortgages, highlighting its potential for long-term savings and increased property value.

Dispelling Myths

Common misconceptions, such as spray foam insulation causing damage to homes or hindering sales, are mostly unfounded. These myths should not dissuade you from considering a property with this form of insulation.

Preparing for a Mortgage Application with Spray Foam Insulation

When applying for a mortgage for a home equipped with spray foam insulation, having all relevant documentation about the insulation can streamline the mortgage process.

Conclusion

Spray foam insulation offers more than just thermal regulation; it can significantly influence your mortgage, from the approval stage to long-term economic benefits.

FAQs

Does spray foam enhance a home's value?

Yes, typically due to its energy efficiency and modern appeal.

Can spray foam impact mortgage rates?

Possibly, as lenders may provide better rates for energy-efficient properties.

Are there health risks linked to spray foam?

Some types may be risky, thus proper installation and adherence to safety standards are crucial.

Can removing spray foam lower insurance premiums?

It might, as insurers often favour homes with efficient insulation.

What is the environmental impact of spray foam ?

It is generally considered eco-friendly, helping reduce energy consumption and greenhouse gas emissions.

Is it possible to remove spray foam insulation?

Yes, expert spray foam removal services are recommended to avoid potential damage to the property.

Leave a Reply

Want to join the discussion?Feel free to contribute!